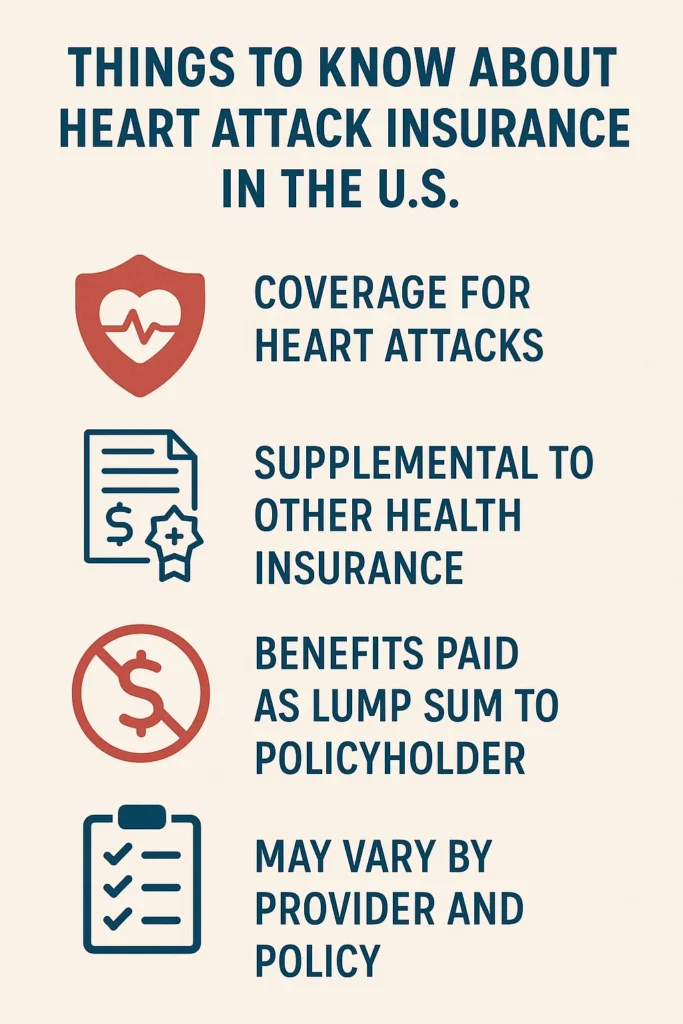

10 Things to Know About Heart Attack Insurance in New York

Navigating the world of heart attack insurance in the U.S. isn’t as straightforward as most people think. It’s not just about having coverage, it’s about knowing what you’re covered for, how it kicks in, and why it matters. Many Americans believe their regular health insurance will cover everything, but critical illness insurance, including heart attack coverage, functions quite differently.

Let’s dive into the 10 most important things you should know about heart attack insurance in the U.S. market. This guide is designed to help you make informed decisions without getting bogged down in jargon.

1. Heart Attack Insurance Is Not the Same as Health Insurance

Most people assume their standard health insurance is enough.

- Health insurance pays your healthcare providers for services rendered, such as hospital stays, surgeries, and medications.

- Heart attack insurance, also known as critical illness insurance, pays you directly.

This distinction is crucial. While health insurance handles medical bills, heart attack insurance puts money in your hands, which can be used for whatever you need: bills, rent, childcare, and even travel expenses.

Bottom line: It’s a lump-sum benefit, not a reimbursement plan.

2. The Benefit Is Paid as a Lump Sum

There’s no drip feed here. If you qualify, you get one payment, fast.

- Coverage typically pays out a one-time, tax-free lump sum if you experience a covered condition, such as a heart attack.

- You can use that money however you choose.

That kind of flexibility is rare in traditional health plans and incredibly valuable when your world turns upside down.

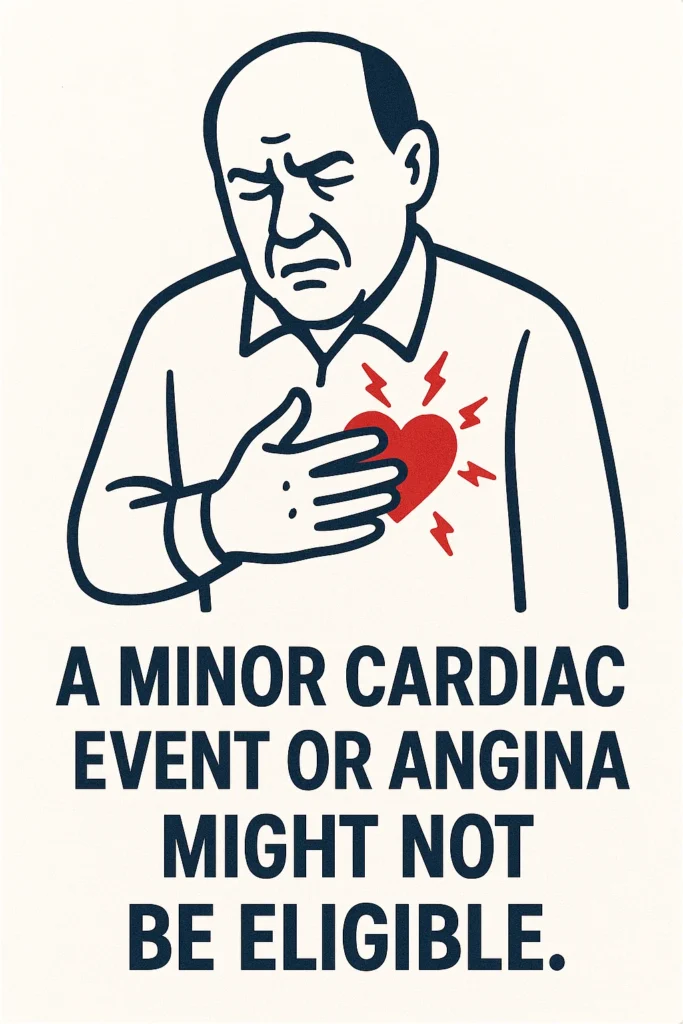

3. Not Every “Heart Attack” Qualifies

Here’s where things get tricky.

Insurance companies have their definition of a “heart attack.” It usually needs to meet specific clinical criteria, including:

- Precise diagnosis with supporting documentation.

- Elevated cardiac enzyme levels.

- Evidence of heart muscle death.

A minor cardiac event or angina might not be eligible.

Tip: Read the policy’s definition of “covered heart attack” carefully before buying.

4. You Still Need Regular Health Insurance

Heart attack insurance is supplementary, not a substitute for primary coverage.

- It doesn’t replace traditional coverage.

- It won’t directly pay your doctors or hospitals.

- It does not cover follow-up care, prescriptions, or rehabilitation sessions.

Instead, it helps bridge financial gaps, the ones people don’t think about until they’re deep into recovery.

5. Payouts Can Help With Non-Medical Costs

A heart attack doesn’t just hit your health, it hits your finances from every angle.

Imagine trying to heal while worrying about:

- Rent or mortgage.

- Credit card bills.

- Lost wages.

- Family responsibilities.

This is where heart attack insurance shines. It gives you breathing room, a buffer when life doesn’t wait.

6. Waiting Periods and Exclusions Apply

Don’t expect coverage to start the moment you sign up.

- Most policies have a waiting period, typically ranging from 30 to 90 days.

- Pre-existing conditions may be excluded for the first few months or longer.

- Some insurers may not pay if the heart attack occurs shortly after the policy is purchased.

Important: Timing matters. Buy early, before you think you’ll need it.

7. It’s Often Bundled With Other Critical Illness Coverage

In the U.S., heart attack insurance is rarely sold in isolation.

- It typically comes bundled with coverage for stroke, cancer, kidney failure, or major organ transplants.

- Some plans allow you to customize which illnesses you want to be covered for.

Bundling can be wise, but be aware. If the focus is on heart attack protection, ensure other conditions in the fine print do not overshadow it.

8. Employer Coverage Might Be Available

Not all heart attack insurance is bought privately.

- Many employers offer group critical illness plans during open enrollment.

- These group plans are often affordable, even if the benefits are more limited.

- The downside? You might lose coverage if you change jobs.

Pro tip: If your job offers it, look into it, but compare it to private options for portability and payout size.

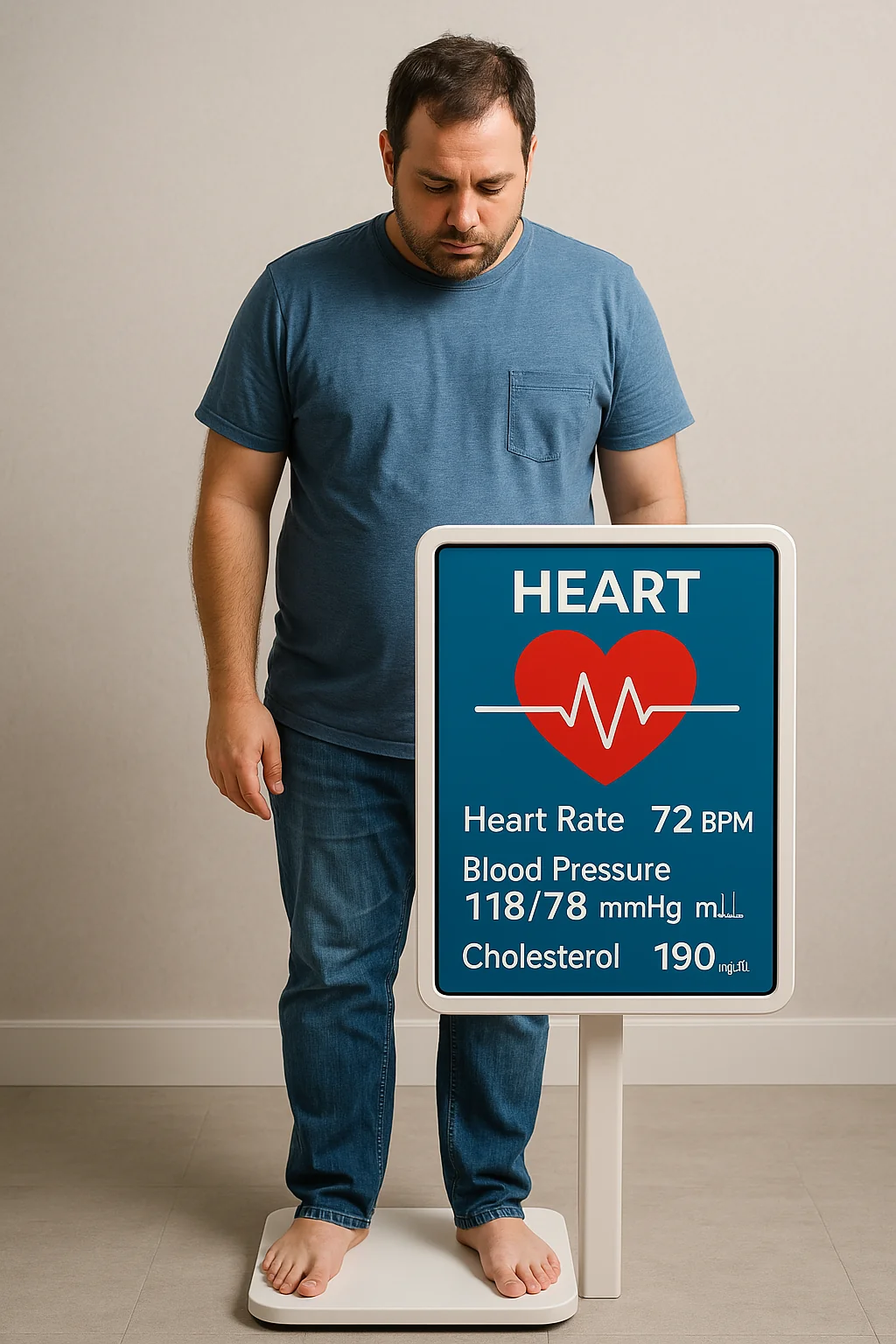

9. Age and Health Affect Eligibility and Cost

This isn’t a one-size-fits-all policy.

- The older you are, the more you’ll likely pay in premiums.

- Chronic health issues can lead to higher rates or exclusions.

- Some insurers may require a health questionnaire or a medical examination.

In contrast, younger, healthier applicants often get lower rates and better terms.

10. Peace of Mind Isn’t Priceless, But It’s Close

A heart attack is devastating. What follows can be just as overwhelming, both financially and emotionally.

Heart attack insurance:

- It helps you focus on healing.

- Protects your savings.

- It keeps your family from scrambling to stay afloat.

It’s not about expecting the worst. It’s about being prepared for what you hope never comes.

Peace of mind isn’t a myth. It’s a policy away.

Additional Considerations

When Should You Consider Heart Attack Insurance?

If any of the following apply, it might be time to consider getting coverage:

- Family history of heart disease.

- High-stress lifestyle or occupation.

- Self-employed or gig worker with limited sick leave.

- Significant monthly bills or financial dependents.

It’s not about paranoia, it’s about preparation.

How Much Coverage Should You Get?

There’s no universal answer, but here’s a practical guideline:

- Consider your monthly expenses multiplied by 6 to 12 months.

- Factor in your deductible and out-of-pocket max on your health plan.

- Add any additional costs, such as rehabilitation, special diets, or time off work.

More isn’t always better, but underinsuring can leave you exposed.

Can You Have More Than One Policy?

Yes, you can. And many people do.

- There’s no rule against owning multiple critical illness plans.

- If each pays out, you can collect from all of them after a qualifying event.

Think of it like stacking protection, layer by layer, just in case.

Heart attack insurance is one of those things we rarely think about, until it’s too late. Yet the costs of a significant cardiac event go far beyond hospital bills. They ripple through your life, touching everything from finances to family life.

In the unpredictable landscape of American healthcare, this kind of supplemental coverage isn’t just practical. It’s powerful.

So, don’t wait for a wake-up call. Take the time to explore your options, ask questions, and prepare because the best time to get heart attack insurance is before you ever need it.

Would you like a downloadable checklist to compare heart attack insurance plans? Or a guide to reading the fine print of critical illness policies? Let me know, I can create that next.

Post Comment